|

Lower Your Taxes - BIG TIME! 2015 Edition: Wealth Building, Tax Reduction Secrets from an IRS Insider

|

|

|

$5.09 |

0071849602

|

|

LLC vs. S-Corp vs. C-Corp: Explained in 100 Pages or Less

|

|

|

$5.97 |

0981454275

|

|

J.K. Lasser's Small Business Taxes 2016: Your Complete Guide to a Better Bottom Line

|

|

|

$5.29 |

111914387X

|

|

475 Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to Hundreds of Tax Write-Offs

|

|

|

$9.16 |

1589797981

|

|

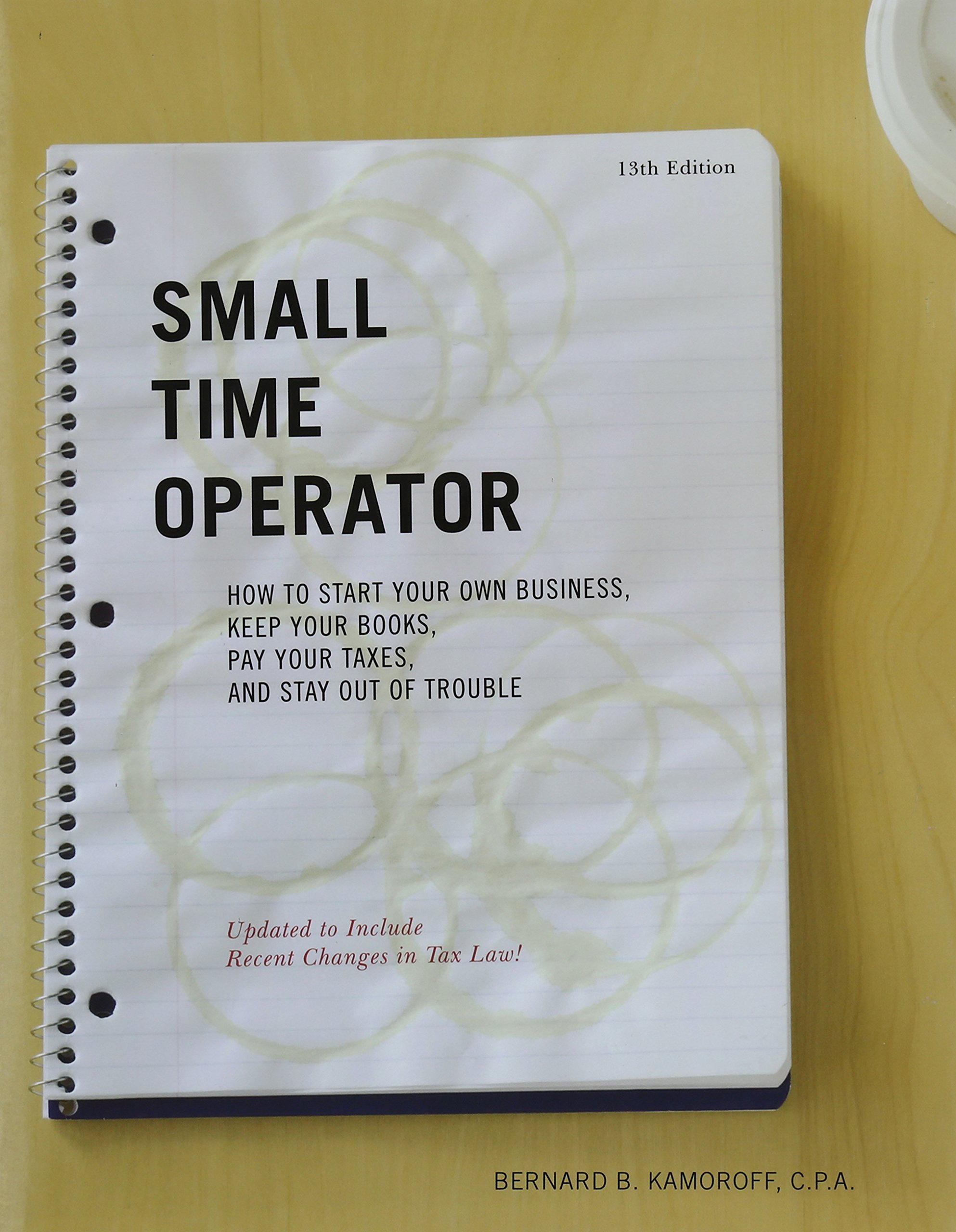

Small Time Operator: How to Start Your Own Business, Keep Your Books, Pay Your Taxes, and Stay Out of Trouble (Small Time Operator: How to Start Your ... Keep Yourbooks, Pay Your Taxes, & Stay Ou)

|

★★★★☆

|

315

|

$5.08 |

158979799X

|

|

The Tax and Legal Playbook: Game-Changing Solutions to Your Small-Business Questions

|

|

|

$11.28 |

159918561X

|

|

The Redleaf Calendar-Keeper 2016: A Record-Keeping System for Family Child Care Professionals (Redleaf Business Series)

|

|

|

$11.25 |

1605544280

|

|

Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and Loopholes

|

|

|

$5.44 |

163006047X

|

|

PassKey EA Review, Part 2: Businesses,: IRS Enrolled Agent Exam Study Guide: 2016-2017, Edition

|

|

|

$26.99 |

193566445X

|

|

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes (Rich Dad Advisors)

|

|

|

$18.59 |

1937832058

|

|

LLC vs. S-Corp vs. C-Corp Explained in 100 Pages or Less

|

|

|

|

B006T5JRG8

|

|

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes (Rich Dad Advisors)

|

|

|

$10.99 |

B00CCTWBWW

|

|

The Tax and Legal Playbook: Game-Changing Solutions to Your Small-Business Questions

|

|

|

|

B00PSSFZSG

|

|

Small Business Tax Deductions Revealed: 29 Tax-Saving Tips You Wish You Knew (For Self-Employed People Only) (Small Business Tax Tips Book 1)

|

|

|

$3.99 |

B00RW169CI

|

|

Taxes For Small Businesses QuickStart Guide: Understanding Taxes For Your Sole Proprietorship, Startup, & LLC

|

|

|

$4.99 |

B017IZCIZO

|